3 Quick Ways to Increase Your Credit Score

These days, many people want an excellent credit score immediately without realizing that it takes time to build a solid credit profile through consistent good credit management. Unfortunately, this impatience can lead to taking risky steps to raise their credit score quickly.

A friend of mine is one of these people and asked me for tips to aggressively and quickly raise his credit score. He wants to buy a house in a few months but is worried his credit score isn’t good enough. Despite explaining what makes a good credit score, he didn’t care because he was in a hurry to take advantage of low mortgage rates before they rise. He needs an aggressive way to improve his credit score now, not in 12 months.

Luckily, there are a few effective and immediate steps he can take to increase his credit score. I’m not talking about widespread advice, such as correcting errors on credit reports, but little steps that he can take now. If you’re also looking for quick and easy ways to boost your credit score, keep reading.

1. Become an authorized user on a good-standing credit card account

When you become an authorized user on someone else’s credit card account, the account’s history is added to your own credit report.

So, if the other person has been using his credit card responsibly (even better if it has a high credit limit with a high account age), your own credit report will reflect this great credit behavior, which will hike up your credit score.

Tip: It’s going to be difficult finding someone who will let you become an authorized user because authorized users are technically not held responsible by credit card companies to pay the debt back (the main cardholder is). Convince the accountholder by telling him or her that you just want to be an authorized user — you don’t want an actual card that would allow you to spend on the account.

2. If you have a secured credit card, increase your security deposit

A secured card is special in that your credit limit is often determined by your security deposit (cash that is put in a deposit account as collateral). For instance, the First Progress Platinum Elite MasterCard Secured Credit Card (one of my top recommended secured cards) allows cardmembers to deposit up to $5,000 for a $5,000 credit limit, while the initial credit limit ranges from $300 to $2,000.

Just deposit more cash and your credit limit will increase. If you didn’t know already, when you increase your credit limit, your credit score will jump up as well.

Normally, with a regular credit cards, you’d have to ask for a credit line increase, which may or may not be approved. With a secured credit card, your credit line depends more on your security deposit — effectively, you have more control on the size of your credit line.

Bonus tip: If you have excellent credit and are in good standing with your credit cards, don’t be afraid to request for a much higher credit limit. MyBankTracker editor Claire recently asked Citibank to up her credit limit from $10,000 to $20,000, effectively doubling her limit.

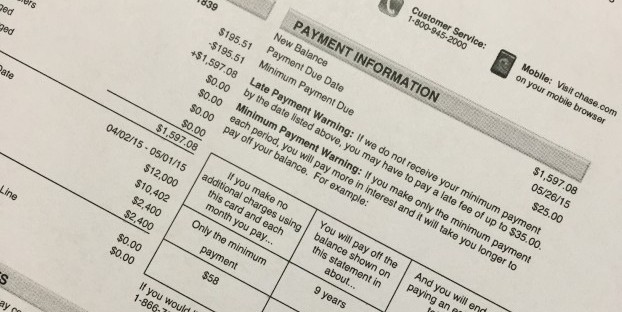

3. Make a partial credit card payment before the billing period ends

The credit card balance at the end of every billing period is reported to the credit bureaus — it becomes your statement balance. You want the credit bureaus to see a smaller statement balance, so that it appears that you are using less of your available credit, which leads to a higher credit score.

By making a partial payment before the billing period ends, a lower balance is reported.

Say you charged $4,500 to your card during the month and you had a $5,000 credit limit. When the billing period ends (statement balance is $4,500), the credit bureaus will see that you are using a whopping 90 percent of your credit limit (not good).

If you make a $4,000 payment before the billing period ended (statement balance is $500), the credit bureaus will see that you used only 10 percent of your credit limit.

When credit scores actually increase

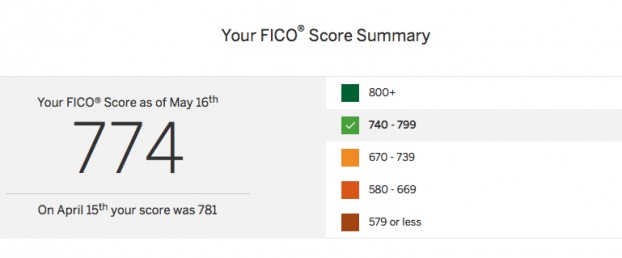

My friend is already following these steps to reach his goal of qualifying for a mortgage. He just happened to have a secured credit card and he’s working on raising his security deposit on that account. Meanwhile, he’s reminding himself to making partial payments to all his credit cards.

The one hiccup in his aggressive push for a higher credit score is getting added as an authorized user. It’s understandable. I wouldn’t feel comfortable adding just anybody as an authorized user to my account either.

We won’t actually see the progress until these changes are reported to the credit bureaus by his card issuers. But, I’m confident that those two moves by him are already going to give him a slight bump in his credit score.

What methods have you used to increase your credit scores in a short period time? I’d love to hear how it turned out for you in the comments.