How to Understand Your Credit Score

An excellent credit score can save you money. You may get lower interest rates on loans and credit cards. And, you could be eligible for additional financial products.

There are many myths about what does, and doesn’t, affect your credit. Learning what actually affects your credit scores can help you make wiser financial decisions.

Why Credit Scores?

A credit score is a number, often a three-digit number, that lenders use to determine the likelihood that someone will default on a loan.

Companies compete to make the most predictive credit scores, and will occasionally release updates to their scoring systems. That’s why we use credit scores, not the singular “credit score.” You might have dozens of credit scores.

Most major lenders in the US use a FICO score to evaluate applicants.

And FICO, founded in 1956, creates credit scores based on information in your credit reports.

However, it doesn’t create the reports themselves. Equifax, Experian, and TransUnion — the three major consumer credit bureaus — do that.

FICO has several different types of credit scores, including base FICO scores and industry-specific scores.

There are also different versions of each score, and FICO has a different scoring model for each bureau. As a result, your credit score can vary depending on which type of score and which bureau a lender wants to use.

However, most of the FICO scores rely on the same criteria. If you’re trying to improve or understand your creditworthiness, you can focus on these factors.

The Fundamentals That Affect Your FICO Credit Scores

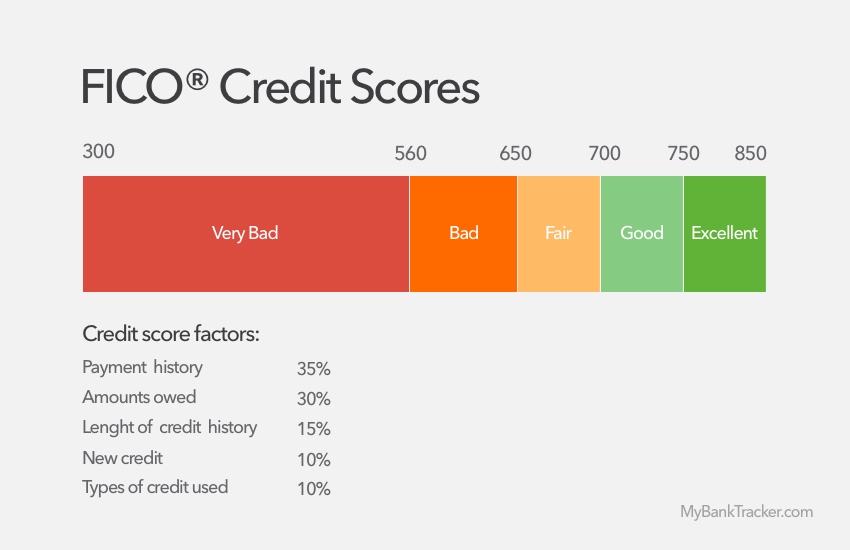

Base FICO scores can range from 300 to 850, with a higher score indicating less risk to lenders.

FICO doesn’t reveal the exact formula that it uses to create credit scores, but it gives a good outline of what does and doesn’t affect your score. It also breaks down the relative importance of each factor.

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you've requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

The percentage weighting applies to “the general population.” It could be slightly different for you, but it’s a good baseline to remember. Also, note that your credit score can change on a monthly basis.

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

How to Improve (or Hurt) Each Factor

Your FICO scores depend on positive and negative information in your credit report. Let’s take a closer look at how FICO uses that data.

Payment history

A history of on-time payments can help your score while being late with a payment can hurt it.

If you have a late payment on your credit report, the negative effect can diminish over time. Making on-time payments can also help offset the negative effect of a late payment.

Your credit reports record how late you are with a payment. A 90-day late payment can have a greater impact than a 30-day late payment.

Similarly, the more that’s owed on a past-due account the greater the impact.

Avoiding late payments altogether doesn’t guarantee you’ll have an 850 FICO score, but it’s a step in the right direction.

Roughly 96 percent of people with an excellent FICO score don’t have any missed payments, and only 1 percent have an account in collections on their credit reports.

Public records information, especially bankruptcies, could have the biggest negative impact on your score.

However, their importance diminishes over time.

After seven to 10 years, public records data falls off your credit report and will no longer impact your scores.

Late payments and collections accounts also fall off after seven years from the date of default.

Amounts owed

Amounts owed is one of the most important factors, but this section often leads to confusion. FICO found that when people use a high percentage of their available credit, they’re more likely to make a late payment or miss a payment.

FICO consider your total debt, as well as the amount you owe on each credit line and how many accounts have a balance.

For installment loans, FICO compares your remaining debt to the original loan amount. With revolving accounts, such as a credit card, it compares the card’s credit limit to the balance that’s reported to the credit bureau.

The amount of available credit you use is your utilization rate. A higher utilization rate can result in lower credit scores.

But, utilization rates are updated each month, and most credit scores don’t take previous utilization rates into account.

Card issuers often report your balance close to the end of your billing cycle. Therefore, even if you pay your credit card bill in full each month a balance still gets reported.

You can avoid this by making an early payment, or try to limit your credit card purchases during the billing cycle. There’s no perfect utilization rate, but try to keep your usage below 20 to 30 percent of your credit limit for each card.

Also, avoid the costly myth that having a balance can help your credit. Lower balances are best, and paying a credit card bill in full each month won’t hurt your credit.

Length of credit history

FICO considers the age of your oldest account, the average age of your accounts, and the age of certain kinds of accounts.

People with an excellent credit score have an average age of accounts of at least 11 years. On average, they also have an account that’s at least 25 years old.

Opening a new account decrease your average age of accounts, but it could also lower your utilization rate.

Closing an account doesn’t immediately remove it from your credit reports. It will stay on your reports, and continue to count towards your average age of accounts, for up to ten years.

Credit mix

Having a mix of different types of credit accounts can help prove you know how to manage credit.

However, FICO doesn’t suggest opening new accounts opening a new account you don’t intend to use.

Your credit mix may be more important if you don’t have much information on you credit reports. Having at least one credit card, with a history of on-time payments, can be particularly helpful.

New credit

Even though it only accounts for about 10 percent of your credit score, the new credit category receives a lot of attention.

When you apply for a new credit account and the lender reviews your credit report or score the event the bureaus record the “hard inquiry.”

Hard inquiries remain on your credit report for two years and can impact your score for up to a year.

It often won’t impact your score by more than a few points, but applying for many new accounts at once could lead to a greater drop.

The credit-scoring formulas recognize that shopping for a loan isn’t always an indication of risk.

If you apply for multiple auto or mortgage loans within 14 to 45 days, it only counts as a single inquiry for credit-scoring purposes.

Check Your Credit Reports

If you’re trying to improve your credit, you may want to start by checking your credit reports. After all, all the above information is gleaned from your credit reports. Dispute any errors you find and look for missing information that could improve your score.

You can request a free copy of your credit reports at AnnualCreditReport.com.

By law, you can request a credit report from each bureau once per year. You may want to start by requesting all three and comparing the results.

In the future, you could spread out your requests and receive a free credit report once every three months.

These Won’t Affect Your FICO Credit Scores

There is also information in your credit reports that FICO doesn’t use to calculate your credit scores:

- When you check your credit report or credit score(s)

- Your age, where you live, and Social Security number (or lack of one)

- Employer-related information

- Child or family support payments

- If you use a credit counseling service

Bottom Line

Knowing what does, and doesn’t, affect your credit scores can help guide your actions as you work to improve your credit.

Checking your credit reports can also be important because your credit scores depend on your reports.

If you want to track a particular score, you could use a base FICO score as a gauge of your creditworthiness.

Most FICO scores rely on the same fundamental factors, so a high base score often translates into high industry-specific scores.

You may be able to get free FICO score from one of your creditors or credit card issuers.