4 Reasons I Turned Down a Store Credit Card, Despite Being Offered a Huge Discount

When the holiday season is heating up and retailers are working overtime to get people into the stores.

On a recent shopping trip, I was amazed to see how many sales there were despite the fact that the holidays were still weeks away.

In one store, I was even promised a 40 percent discount on everything I was buying, in addition to the sale prices.

All I had to do, of course, was sign up for their credit card.

While I turned it down, there are likely to be plenty of shoppers who won’t, so if you’re considering getting a store credit card over the holidays, here are the four things I kept in mind, and you should too.

1. Size up the discount

If you’ve ever been put on the spot at the cash register, you know how tempting it is try and score a better deal on what you’re buying.

It’s that promise of saving 10, 20 or even 30 percent off your purchase that usually lures people in to getting a store credit card without actually reading over the terms and conditions.

By the time you get around to taking a look at the card’s brochure, you’ve likely agreed to much more than you bargained for.

While the discount I was offered was certainly steep, it wasn’t enough to convince me to open an account.

The items I purchased were fairly small; in fact, I think spent less than $15 total so the savings wouldn’t have amounted to more than the cost of a cup of coffee.

Someone who’s shelling out big bucks for a gift, on the other hand, could see some real savings by opening a store card.

Solution? Weighing out how much of a difference the discount makes in your spending can make it easier to see what kind of value you’re really getting.

2. Run the numbers on the interest rate

Retail cards, for the most part, tend to carry much higher interest rates compared to regular credit cards.

Taking a quick glance at the APR or annual percentage rate can give you an idea of what the cost of using the card is if you keep a balance from month to month.

I have one pretty popular store card, for example, that charges an APR of 22.9 percent while my other cards are all somewhere in the 10 to 13 percent range.

Needless to say, this one doesn’t get used too often.

Even if you don’t get that big initial discount, you can still save money with your rewards credit card if it pays you cash back on the things you buy.

You also come out ahead if the APR is lower than the what the store card is charging, especially if you don’t pay it off in full each month.

Solution? Comparing the store card’s interest rate to the ones you already have is a good idea, especially if you’ve got a rewards card or two in the mix.

3. Check the grace period

Some retailers try to entice shoppers to sign up for their card with a generous promotional offer.

Not only do you get that deep discount on your first purchase, but you also get six months or a year to pay it off without being charged any interest.

While that seems like a bargain, it’s actually problematic if you’re not super diligent about paying the balance off before the grace period ends.

I’ve gone down the promotional offer road before and fortunately, I was able to wipe out the debt before the interest kicked in, but other people may not be so lucky.

Solution? When you’re looking into getting a store credit card to try and snag that zero interest deal, you need to calculate how long it’ll take you to pay it off. If the promo period ends and you still owe a few bucks, all of that interest that’s been deferred up to this point will be tacked on to your bill, which means you really haven’t saved anything at all

4. Think about how useful it really is

The store that I was offered a card at isn’t a place I frequent on a regular basis.

I may have visited it twice in the last year, if that. Even though the cashier told me I’d be eligible for additional discounts and coupons down the road, signing up for a card I wasn’t sure I’d use again just didn’t make sense.

Anytime you apply for a new credit card, it shows up as an inquiry on your credit report.

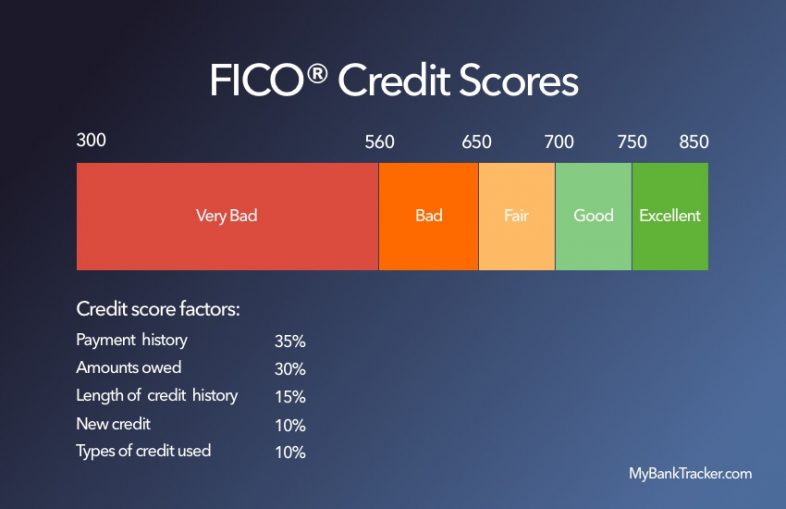

The number of inquiries you have accounts for 10 percent of your FICO credit score and the more you rack up, the more points it can knock off.

Paying off the card after the holidays and then closing it right away can do even more damage, since the age of your accounts also affects your score.

Taking into consideration the potential cost to your credit can guide your final decision.

Solution? If you’re hitting store after store and signing up for cards everywhere you go, you could be taking your credit without even realizing it. Before you sign on the dotted line, it’s important to think about how much mileage you’ll actually get out of that store account.