Don’t Get a Payday Loan: Consider These Alternatives

Everyone has faced a situation where they need money they don’t immediately have.

Some people can hit up a rich relative. Some people can take out a loan from a bank or get a credit card.

But, for most people in a dire situation, the easiest and most accessible option?

Going to a payday loan shop.

And, yes — it is the worst possible solution to needing money quickly.

Payday loans are bad for you. Very, very, bad.

They’re so bad for you that they’re banned in 18 states and Washington D.C., who all prohibit the act of charging exorbitant interest rates on loans.

In those states, the payday loan industry is viewed as predatory, and criminal.

If you’re in desperate need for money quickly, we have solutions for you that don’t involve getting wrapped up in a payday loan.

We dive in to what exactly payday loans are, and the better, safer options you consider instead of them.

Legal Status of Payday Loans

Although regulations are in place for payday loans, not every state has outlawed the enormous interest rates.

According to the Payday Loan Consumer Info:

“Payday loans at triple-digit rates and due in full on the next payday are legal in states where legislatures either deregulated small loans or exempted payday loans from traditional small loan or usury laws, and/or enacted legislation to authorize loans based on holding the borrower’s check or electronic payment from a bank account.”

However, a handful of states have taken a very strong stance against them.

In fact, they are viewed so unfavorably in Georgia that the payday loan shops are banned under racketeering laws.

They are considered to be in the same league as loan sharking, and opening a payday store is literally engaging in organized crime.

The other 32 states, however, have passed legislation specifically protecting the payday loan industry, where APRs routinely climb into the the triple digits and the average payday loan rate coming in at 339 percent a year.

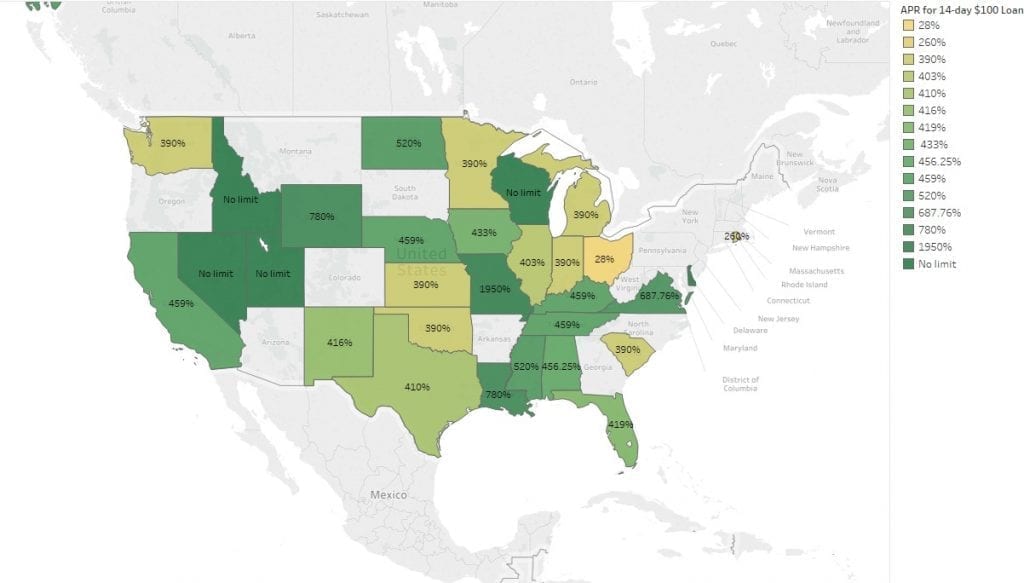

Here’s a graphic to represent the states that allow payday loans and the APR that can be added for a 14-day, $100 loan:

APRs for some payday lenders routinely climb exponentially higher, to 1,000, 2,000, even 7,000 percent.

To put this in perspective:

If you take out a $500 loan at a payday loan place with an APR of “just” 339 percent, after one year, you would end up paying $1,785.37, or $1,285.37, just in interest.

To be sure, the majority of payday loan places don’t expect you to take 365 days to pay off the loan, and are usually set for a two week period.

But what if you don’t pay off the balance in two weeks?

You’ll be forced to take out another loan to pay off the old one — and don’t be thinking you’ll get a better rate the second time around.

Why Do People Take Out Payday Loans?

A lot of advice concerning alternatives to payday loans tends to take on a fairly paternalistic tone, assuming that people take them out because they just can’t wait to get a new TV or some other frivolity.

The truth is most payday loan borrowers are just average people looking to get their bills paid.

Millions of people a year use payday loans, with the majority using them not for luxuries but for essentials like rent and utility bills.

People take out payday loans not because they want things, but because they need them.

Looking at the absurdly high interest rates it seems like there’s no reason to ever take out a payday loan.

In a world where everyone had access to the same loans, taking out one with such a high APR would make zero sense.

But people don’t have equal access to fair credit, and when there’s a sudden need for cash, often the easiest recourse is taking out a payday loan. But it‘s not the only option.

What are Some Payday Loan Alternatives?

If you’re staring down a bill that needs to get paid, or you need groceries, or you just need money for one of life’s many unpredictable expenses, do anything but get a payday loan. It helps to know the options:

Peer-to-peer lending

Peer-to-peer is one of the biggest, most novel recent innovations of the tech world, spanning industries from file-sharing (PirateBay) to crowdfunding (IndieGoGo, Kickstarter) to entire currencies (bitcoin).

“P2P” has made its way into the world of banking, allowing people to get loans from another individual, almost always at a far better rate than a payday loan shop would offer.

Two of the most notable peer-to-peer lenders to emerge have been Prosper and Lending Club.

People looking for money merely list how much they’re looking for, and what they plan to use the money for.

Then amateur lenders (hoping to make a bit on interest) supply loans with the platforms acting as a sort of intermediary.

Risk is diversified, as the majority of lenders contribute small amounts to cover one borrower’s request.

The peer-to-peer lending industry is booming, and if you can match up with someone willing to lend you a spot of cash, it can be a much, much more palatable option than a payday loan.

The APRs of P2P lending tends to be pretty good, with APRs that can be as low as 6.78 percent, with an average of 15 percent.

However, like any type of loan, the interest rates will vary depending on your credit and other financial information.

Small bank or credit union loan

Community banks and credit unions are more eager to deal with individuals than their big-bank counterparts when it comes to small personal loans — at a more favorable rate than a payday loan shop.

Of course, getting one of these usually requires having better than normal credit. But the rates — which sport interest in the single digits as opposed to, oh 7,000 percent — make them far more attractive than payday loans.

Credit cards for people with poor credit

If getting a personal loan from a peer-to-peer site, a small bank or a credit union is not an option, getting a credit card can be a temporary solution.

They’re much better than getting a payday loan and, in rare cases, credit cards may even carry lower interest rates.

Our top credit card recommendation for people with poor credit is the Capital One Platinum Secured.

It has a decent percent regular APR and you do have to pay an annual fee, in addition to required security deposits.

You only need an initial security deposit to get access to a credit line.

Another good option to consider is the First Progress Platinum Prestige MasterCard Secured Credit Card.

Want to see more?

Check out MyBankTracker’s list of best credit cards for people with poor credit that are worth using judiciously to rebuild credit.

To be sure, a credit card isn’t a magical respite from your money woes, and if you fail to pay them back you’ll get into the same kind of problems you would with a payday loan place (albeit at a slower pace).

But once again, when picking between the relatively high APR of a poor credit card or a payday loan shop that charges literally criminal interest rates, the choice is clear.

Steer clear of the payday loans, and go with the payday loan alternatives.