What You Need to Know When Using Home Equity Loan to Buy Another Home

Imagine waking up to the sound of waves crashing on the beach, or looking out the window at snow-capped mountains as you sip hot chocolate next to the fireplace?

Having a second home for relaxing getaways sounds enticing.

Whether it’s for pure enjoyment or an investment opportunity, there are many reasons people look at buying a second home.

However, before you shop around, you’ll need to explore financing options.

If your primary residence is worth more money than you owe, a home equity loan might be a good option to make your dreams come true.

What is a Home Equity Loan?

With a home equity loan, homeowners borrow a lump sum of money against the equity of their home.

Sometimes referred to as a second mortgage, a home equity loan is similar to your “first” mortgage.

The loan plus interest is paid back on a monthly basis over a set period of time.

If you still owe money on your first mortgage, you’ll pay the home equity loan payment each month, in addition to your mortgage payment.

A typical home equity loan term ranges from as little as five years up to 15 years.

Home equity

A home equity loan is guaranteed by the value of your main home. You’ll want to know how much equity you have available in your home.

Equity is the difference between the appraised value of your home minus the amount of money owed on a mortgage or loan.

There are two ways to build equity:

- Your property value increases

- The amount of debt owed on the home decreases

The more equity you have, the more cash that is available to borrow against the value of your home.

Loan-to-value ratio

A loan-to-value ratio (LTV) is the term used to explain how much money you owe on the mortgage taken out on your main home. If you want to take out a home equity line of credit to buy a second home, lenders will look at your LTV.

To start, you’ll need to get a professional appraisal on your home to determine the current value. You’ll also need to know the outstanding balance on your mortgage.

The loan-to-value ratio is calculated with these two numbers:

Current mortgage balance ÷ Current appraised value = LTV

For example, if your home is appraised for $250,000 and you owe $100,000, you have $150,000 in equity.

The LTV ratio is:

$100,000 ÷ $250,000 = .40

Converted to a percentage, that gives you a LTV ratio of 40 percent.

Combined loan-to-value ratio (CLTV)

Most lenders required your CLTV to be 85 percent or less in order to qualify for a home equity line of credit.

To calculate your CLTV, you’ll add the amount of money you want to take out as a home equity line of credit, combined with the outstanding mortgage. This is your combined loan balance. The CLTV formula is:

Combined loan balance ÷ Current appraised value = CLTV

Using the example above, to calculate your CLTV on a $75,000 home equity loan, you’ll add the $100,000 owed on your mortgage to determine the combined loan balance of $175,000.

Your CLTV ratio is:

$175,000 ÷ $250,000 = .70

Converted to a percentage, that gives you a CLTV ratio of 70 percent.

With this example, you would qualify for a home equity line of credit since your CLTV is below 85 percent.

Of course, there are other factors that come into play when you apply for a home equity line of credit, like payment history and credit score.

Benefits of a Home Equity Loan

A home equity loan is a secured loan. This type of loan is desirable for lenders and borrowers alike.

Some benefits of taking out a home equity loan to purchase a second home:

Low interest rates

Interest rates on a home equity loan are typically lower compared to a second mortgage or personal loan.

This is because you, the borrow, is considered lower risk, since the loan is secured by the collateral of your main house. Lower risk means lower interest rates.

In addition, a home equity loan is a fixed-rate loan so once the rate is locked in place, it cannot increase over the life of the loan.

Cash down payment

Once you’re approved for a home equity loan, the money you receive serves as a cash down payment for the purchase of your second home.

If the home equity loan covers the total amount of your second home, you won’t need to take out a second mortgage.

Tax advantages

Interest paid on a home equity loan up to $100,000 is still deductible under the Tax Cuts and Jobs Act of 2017.

In order to deduct the interest paid, the home equity loan must be used to buy or build a second home or make substantial improvements to the main home.

Risks of a Home Equity Loan

Borrowing any amount of money comes with a certain level of risk. By taking out a home equity line of credit, you’re putting your main home at risk.

Interest rates

Because home equity loans have a fixed interest rate, if rates do fall, you will not benefit from a lower interest rate.

Change in income

If you’re income flow drastically changes, there is the risk that you won’t be able to cover the cost of two homes. If you cannot pay back the loan, you could lose your main home to foreclosure.

Sale of your main home

If you decide to sell your main home, you’ll have to repay the remaining balance on the home equity line of credit once the sale is finalized.

The proceeds from the sale will have to pay off the debt of the home equity loan so you can’t count on that amount of money towards the purchase of a new home.

How Do I Apply for a Home Equity Loan for A New Home?

To qualify for a home equity loan, the lender will consider the following:

Income

The most common documentation requested to show proof of income are pay stubs, W-2s, tax returns, bank statements and work history.

Credit score

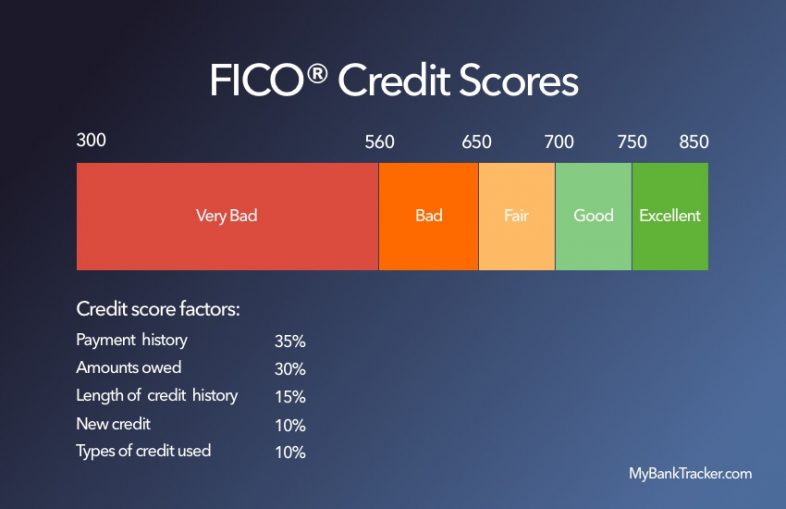

Your credit score is a crucial part of the application process. A low credit score shows that you’ve made some financial mishaps that negatively impacted your credit health.

Combined loan-to-value ratio

The CLTV is the percentage of outstanding debt on the home.

To qualify for a home equity loan, most lenders accept a CLTV of less than 90%.

Debt

The amount of money you pay each month towards debt impacts your ability to qualify for a home equity line of credit.

Debt such as a mortgage payment, credit card balances, student loans, car loans and personal loans come into play when you’re applying for additional credit.

To qualify, the percentage of your money income towards debt payments should not exceed 43%.

Once you’re ready to move forward with the application process, you’ll want to shop around. Finding the best lender requires homework, but rest assured, it pays off.

Just because you have a mortgage with a specific financial institution doesn’t mean they’re the best deal in town. Convenience can come with a hefty price tag.

In fact, many banks and credit unions are hungry for new business and might offer extra incentives.

What You Should Keep in Mind

Just because you qualify for a home equity loan doesn’t mean that you should take one out.

Buying a second home is a big decision, and small details shouldn’t be overlooked.

From a leaky roof to lawn care, you’ll want to understand the full cost of owning a second home before you commit.

Having an emergency fund can save you from financial disaster. The addition of a second home increases the chances of unexpected costs.

The amount of money you should keep in an emergency fund depends on your monthly expenses. Experts recommend having anywhere from 3 to 6 months of living expenses in your emergency fund.

Because a home equity loan puts your main home at risk, you might want to err on the side of caution and have up to 12 months of expenses saved in your emergency fund.

To calculate how much to have in an emergency fund, you’ll need to include monthly expenses associated with a second home, on top of your primary residence.

At the end of the day, you don’t want to put yourself at financial risk just to own a second home.

Conclusion

Buying a vacation home or rental property is a long-term investment. Don’t rush into the decision.

Whether its additional income or waking up to the sun rising over the ocean, it’s a personal decision only you can make.

If you’ve done your homework and comfortable with buying a second home, enjoy the payoff as it can be quite significant.