Deferment vs. Forbearance for Student Loans

If you’re like most people, you didn’t have a huge college fund waiting for you after graduating high school.

So getting an education met doing so on your own dime.

Several student loan options can help finance higher education. And in most cases, your first loan payment isn’t due until after graduation.

When the time comes to pay what you owe, you might not earn enough to afford the monthly payment. This can be due to difficulties with finding work, an illness, or other economic hardships.

Depending on your circumstances, however, you may qualify for either a deferment or forbearance.

Compare Deferment vs. Forbearance

| Deferment | Forbearance |

|---|---|

Pros:

| Pros:

|

Cons:

| Cons:

|

What is Deferment?

Deferment reduces your monthly payment or allows you to stop making your loan payment on a temporary basis. This is an option if you can’t make your student loan payment or if your payments are too high.

Qualifying for deferment depends on your type of federal student loan. Some federal loans don’t require borrowers to pay accrued interest during deferment. Deferment may be available up to 3 years.

Interest During Deferment Period

| You ARE NOT responsible for paying the accrued interest on these loans during deferment: | You ARE responsible for paying the accrued interest on these loans during deferment: |

|---|---|

| Direct Subsidized Loans | Direct Unsubsidized Loans |

| Subsidized Federal Stafford Loans | Unsubsidized Federal Stafford Loans |

| Federal Perkins Loans | Direct PLUS Loans |

| The subsidized portion of Direct Consolidation Loans | Federal Family Education Loan (FFEL) PLUS Loans |

| The subsidized portion of FFEL Consolidation Loans | The unsubsidized portion of Direct Consolidation Loans |

| The unsubsidized portion of FFEL Consolidation Loans |

Eligibility

You must meet one of the following eligibility requirements to qualify for deferment:

- You’re in school at least part-time

- You’re unemployed or can’t find full-time employment

- You’re experiencing economic hardship

- You’re serving in the Peace Corps

- You’re on active duty military

- You’re in a graduate fellowship program

- You’re in a rehabilitation training program for the disabled

- You’re working toward cancellation of your Perkins Loan

What is Forbearance?

Forbearance also reduces your monthly payment or suspends monthly payments temporarily. Periods of forbearance come in 6- to 12-month increments. You are responsible for paying accrued interest on loans during forbearance.

Eligibility

If you don’t qualify for a deferment, you might qualify for forbearance.

There are two types of forbearance: mandatory and general. Your loan servicer can deny your request for a general forbearance.

But can’t deny your request for a mandatory forbearance.

Requirements for general forbearance include:

- Financial hardship

- Medical expenses

- Employment changes or employment difficulty

Requirements for mandatory forbearance include:

- You’re enrolled in a medical or dental internship, or you’re enrolled in a residency program

- Your student loan monthly payments are 20 percent more than your monthly gross income

- You’re serving in an AmeriCorps position

- You’re in the process of qualifying for teacher loan forgiveness

- You’re a member of the National Guard, but not eligible for military deferment

- You qualify for partial repayment under the U.S. Department of Defense Student Loan Repayment Program

How Do You Request Deferment or Forbearance?

Your student loan servicer automatically defers payments if you’re attending college at least part-time.

During this time, you’re not required to make a payment. Repayment begins shortly after your attendance drops below part-time or you graduate.

To request deferment or forbearance at this point, contact your loan servicer and fill out a request form.

Although you can call your provider, you may also be able to submit a request through your servicer’s online portal.

Look for information on managing repayment or preventing default once you’re signed in.

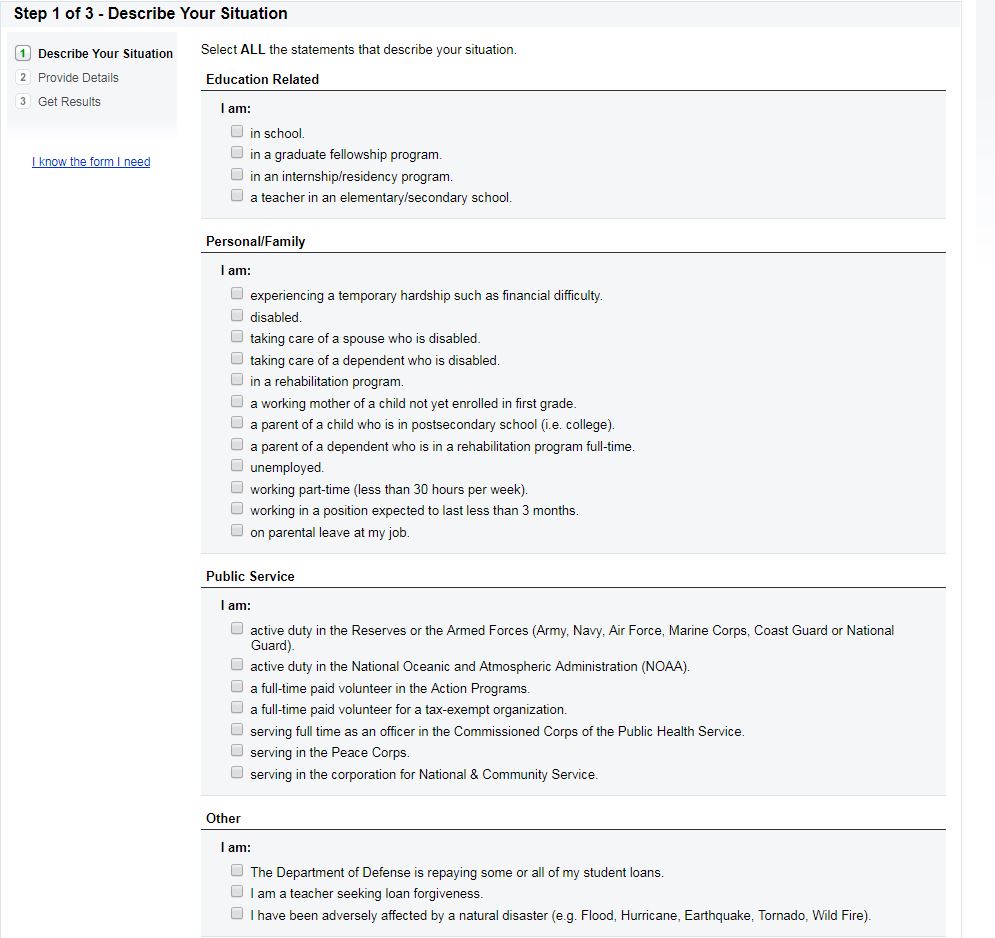

If you don’t know whether you qualify for deferment or deferment, complete an eligibility quiz or questionnaire.

Here is an example:

Download the appropriate form or submit an online request once you know which program you qualify for.

It can take up to 7 to 10 days for your loan servicer to approve or deny your request. Until you hear back, continue to make your student loan payment as scheduled.

Which Is the Right Choice for You?

A deferment or forbearance can solve student loan repayment issues. When you’re not required to pay interest, deferment is generally better than forbearance because it doesn’t increase your principal balance.

Therefore, you avoid paying hundreds or thousands of dollars in interest over the life of your student loan.

Even so, both options will only solve financial problems for the short term.

This is when you experience a hardship, but expect your financial outlook to improve. At which point, you’ll be able to afford your monthly payment.

Then again, you may feel that your hardship is permanent or will continue for an extended period.

If so, consider an income-driven repayment plan. Under this program, your income and family size determines monthly payments.

Your payment can be as low as $0 a month. And after 20 to 25 years, your loan servicer forgives any remaining balance on your student loan.

What to Do During Student Loan Deferment or Forbearance?

Deferment and forbearance can provide the financial break you need. But these provisions aren’t permanent and monthly payments will resume.

It may seem impossible to even think about taking a look at your debt after your deferment period is over.

The important thing is to make sure you took this to time to reevaluate, save up some money, and gather yourself up to pay back your debt.

Use this time to prepare your personal finances for future payments.

Here’s what you can do to make student loan repayment easier on your pocket:

Open a high-yield savings account

Deposit a percentage of your income each pay period. Aim for at least 10% of your income.

Set up automatic transfers from your checking account to your online savings account. Or have a part of you check direct deposited into your savings account.

Look for ways to earn extra money

A second income stream can provide extra cash. This can ease the financial burden of student loan repayment.

Use income earned from a side hustle to double or triple your monthly minimum loan payment. This can help you pay off the debt sooner.

Plus, extra cash makes it easier to pay accrued interest during deferment or forbearance.

Refinance or consolidate your student loan

Your servicer may deny your request for a deferment and/or forbearance.

If you need to lower your monthly payment, look into consolidation or refinance. This combines many student loans into a single loan.

Consolidating or refinancing can reduce your interest rate and monthly payment.

Top Student Loan Refinancers

| Lender | Borrowing Amounts | Available Terms | Eligible Loans For Refinancing |

|---|---|---|---|

| CommonBond | $1,000 to $500,000 | 5-, 7-, 10-, 15-, and 20-year terms (Hybrid Rate loans are only available for 10-year terms) | Both Private loans and Federal loans |

| Citizen's Bank | $10,000 to $90,000 | 5-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| Discover Bank | $5,000 to $150,000 | 10- and 20-year terms | Both Private loans and Federal loans |

| Earnest | $5,000 to $500,000 | 5-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| PNC | $10,000 to $75,000 | 10-, and 15-year terms | Both Private loans and Federal loans |

| SoFi | $5,000 to the amount your schooling costs | 5-, 7-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| Wells Fargo | $5,000 to $120,000 | 5-, 10-, 15-, and 20-year terms | Only Private loans |

If you took out several federal loans, a Direct Consolidation Loan allows you to combine all of them into one so you only have a single monthly payment to worry about.

Just remember,

You can refinance your federal loans into private loans, but you cannot refinance your private loans into federal loans.

So this means,

Private loans are not eligible for a federal Direct Consolidation Loan.

Borrowers can also use the federal consolidation program to convert variable loans to a fixed rate or extend the length of their repayment term.

Generally, you can consolidate if you took out Direct loans, Stafford loans, Perkins loans, PLUS loans and Health Education Assistance loans.

Consolidating federal loans is fairly straightforward. The entire process takes place online and there’s no fee involved to apply. Once the new loan is disbursed, you’ll have to start making payments within 60 days.

Pros vs. Cons of Direct Consolidation Loans

| Pros | Cons |

|---|---|

|

|

Research student loan forgiveness

Loan forgiveness cancels or discharges a part of your federal student loan debt. But not every loan or borrower qualifies.

You must work in a qualifying career and submit at least 120 qualifying monthly student loan payments.

Qualifying careers include those with a federal, state, or local government organization or a not-for-profit organization.

Conclusion

Student loan repayment is sometimes easier said than done.

But don’t let lack of cash send your account into default, resulting in late fees and a damaged credit score.

Know your options for managing student loan repayment. And then take advantage of provisions like forbearance, deferment, consolidation, or income-based repayment.

These options can keep your head above water until your financial situation improves.