Can Your Credit Score Suffer Because You Have Student Loans?

Your credit score is that tricky number that really only matters when you need it.

Your student loans can affect your credit score in a good and bad way.

Is it possible though for your credit score to decrease just because you have student loans?

The short answer, simply, is no.

Learn how your student loans are related to your credit score, including the different ways that your credit can be affected.

First Things First; What is Your Credit Score?

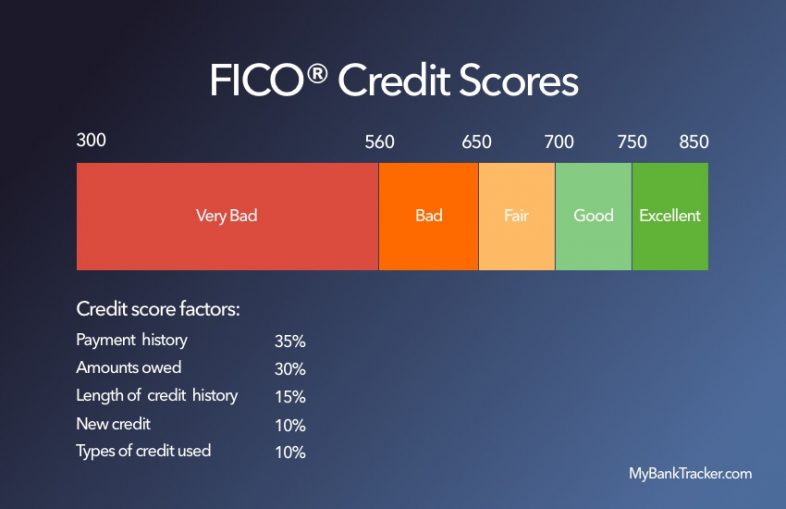

A FICO score is a credit score, or grade, created by the Fair Isaac Corporation.

Three credit bureaus issue credit scores: Experian, Equifax, and Transunion.

When you apply for credit from a lender such as for a home mortgage, or vehicle lease, they will check your credit rescore to assess credit risk.

The higher your credit score, the more attractive candidate you will be.

Five factors determine your credit score:

Amounts owed

Amounts owed includes all accounts. For installment loans like student loans, this is a percentage of debt still owed.

For credit card accounts, this is a ratio of available credit to used credit.

Payment history

The payment history part of your credit score tells lenders if you’ve paid past credit accounts.

Your payment history accounts for the largest portion of your credit score.

Length of credit history

Your credit history shows how long your credit accounts have been established.

It is broken down into the age of your oldest account, the age of your newest account, and an average age of all your accounts.

Credit mix

Credit mix is a calculation of your active credit, including credit cards (revolving credit), retail accounts, installment loans, and mortgages.

New credit

Credit bureaus think that opening several accounts in a short period of time represents greater risk, and could be indicative of financial strain.

So, if you’re just starting student loan payments, and you also just opened up a credit card, you could see a score drop.

Can Just Having Student Loans Hurt Your Credit?

Generally, simply getting a student loan will not make your credit score go down.

Student loans are a very common type of debt, and millions of people are paying down student loans. If your credit score has decreased and you think it’s because you simply bear student loans, that’s not the case.

Student loans are treated as installment debt and are in the same category as personal loans or vehicle loans.

While high balances on a credit card can have an impact on your credit score, this is not the case for student loans.

So having $75,000 in credit card debt may be harmful to your credit score, but having $75,000 in installment loan debt may not be.

Your credit report will focus on your record of on-time payments.

By the nature of having student loan debt, even a lot of debt, does not mean you will not be able to qualify to rent a home, get a mortgage, or purchase a car.

If you pay your student loans regularly and on time, having student loans can increase your credit score.

On the other hand, here are some typical reasons why your credit score could drop, due to your student loan, are:

You missed a monthly payment

A late or missed payment (discussed further below) can have a negative impact on your credit report.

You just started repayment

Typically, education debt appears on a credit report shortly after opening, but will be marked “deferred” until you enter repayment. The balance will not be calculated into utilization.

Once you start repayment, your score may drop slightly, because your balance of debt owed will jump up and utilization will increase.

You were applying for new credit

Applying for credit causes a small drop on your score, usually just several points, and is temporary.

There was an error

Errors on your credit report are common. If you spot errors on your credit report, you can dispute them.

Negative Marks to Avoid on your Credit Report

The following negative marks can have a significant impact on your credit score for a long period of time.

Often times, negative marks are combined with other negative remarks.

For example, if you are having trouble making your monthly mortgage payment, and eventually it is foreclosed, you may have a foreclosure along with multiple late payments.

Make every effort to avoid these:

Late payments

Late payments may be designated 30, 60, 90, or 120 days late. A late payment may stay on your credit card for seven years from the date of the delinquent payment.

Accounts in collections

When a creditor believes you will not pay a balance, usually following a certain number of missed payments, they can write if off for tax purposes, and/or sell it to a third-party collections agency.

This charge-off will be a negative mark on your credit report for seven years from the date of your first delinquent payment.

Bankruptcy

When you seek relief from debt obligations through a bankruptcy legal proceeding, it will be noted on your credit report (along with other late or missed payments).

A Chapter 13 bankruptcy will stay on your credit report seven years, and a Chapter 7 Bankruptcy will stay on your credit report 10 years.

Note: It is very difficult to discharge student loan debt in bankruptcy.

Foreclosure

If you behind on mortgage payments and the bank forces the sale of your home, you will receive a negative mark on your credit report, which will stay for seven years.

Tax lien

If you do not pay your taxes, the federal government can attempt to collect your debt by filing a lien against your property. Unpaid tax liens may stay on your credit report indefinitely, while a paid tax lien will stay on your credit report seven years from the filing date.

The impact a negative item has on your credit report will decrease over time. In other words, if you had a late payment six years ago, this will impact your score much less than a late payment two months ago.

Although some items do not fall off your credit report for 7-10 years, many credit-scoring models look only at the last 24 for months.

Smart Education Financing

Knowing how installment debt works compared to revolving credit card debt, you should think twice about financing any education with a credit card, or for that matter, using a credit card for any large purchase you will be paying off over time.

If you are unable to get traditional education financing because you are pursuing a specific trade (pilot training, cooking school, etc.), consider applying for a personal loan before whipping out your credit card to finance your education, computers, and supplies.

Paying Off Your Student Loan Early

Although it makes sense that paying off a loan is a sign of responsible financial management, your FICO score may not reflect a positive change.

If you paid off your student loans completely, your credit score could drop.

If you have credit card debt, focus on paying that down first and making your regular payments on your student loan.

It’s important to remember that installment debt is a completely different animal than credit card debt.

Many people report drops in their credit score when paying off installment debt (car loans or student loans) early.

There are several reasons this could happen:

Your student loan is your only installment loan

About 10% of your credit score has to do with your “mix” of active accounts.”

Lenders and banks think that consumers that demonstrate financial responsibility in a variety of credit accounts show a lower risk of not paying down debts.

You have high balances on other loans

If you have several installment loans, such as a personal loan, a car loan, and student loans.

If you pay off your student loans, but still have high balances on your car loan and personal loan, your credit score may drop 10 to 25 points.

In almost all cases, it is a good idea to pay down your debt. If you have only one installment account, your student loan, it might make sense to pay down to a very low balance and keep the account open.

Talk to a financial advisor, credit counselor or trusted mentor about the smart decision for your financial situation and credit.

Take Control of Your Financial Future

If your credit score is low, or you are in deep amounts of student debt, do not let it discourage you.

With on-time payments and smart financial decisions, you will be able to bring your score up.

If you can afford to make more than the minimum monthly payment on some of your debt, focus on revolving credit card debt first.