The Financial Strategy You’ve Never Tried (But Should)

When it comes to managing money, setting financial goals is important. Setting financial goals can help you get ahead, stay on track, and enable you to focus on the bigger picture.

Many of us have financial goals like wanting to make six figures or pay off our debt. And sometimes, those goals can feel so out of reach that it’s hard to know where to even start. If you’re looking for out-of-the-box solutions for your money goals, here are some unique options to consider.

Money Strategies You’ve Probably Never Tried

1. Write a letter

A few years ago, I was deep in student loan debt, struggling to find work, and deeply depressed about my situation. I thought I did everything right, I worked hard, went to school, and played nice. What I was left with was a ton of student loan debt and no career to show for it.

After spending the first couple of years post-graduation feeling frustrated and sad, I decided to turn my negative energy into something positive. I started my blog, Dear Debt, and chronicled my journey out of student loan debt.

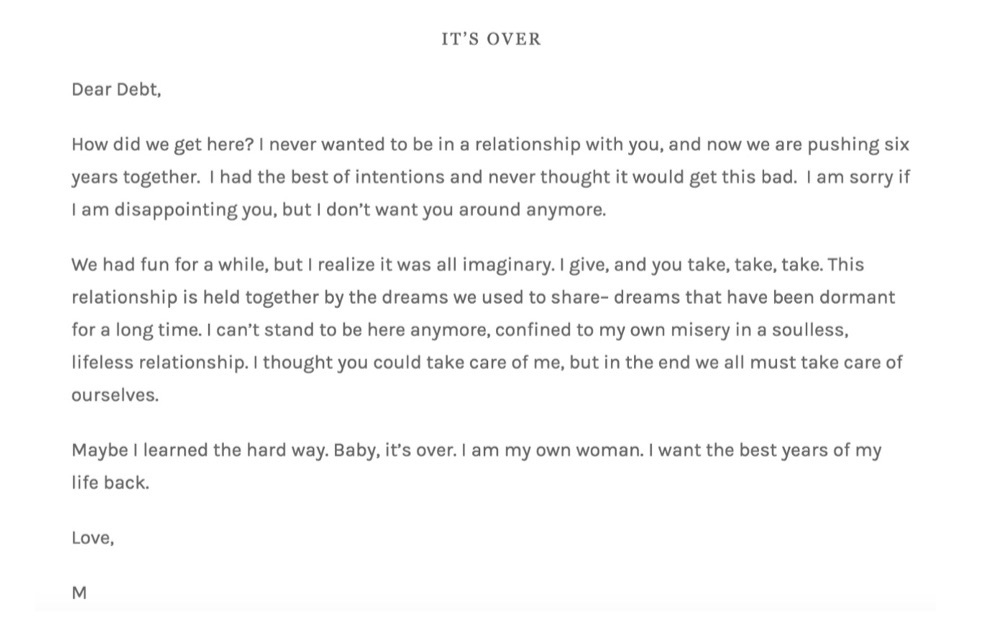

It was a step in the right direction and changed the course of my life. At the heart of the blog are the dear debt letters, which are essentially Dear John (aka breakup) letters to debt.

The dear debt letter project was born after I realized that the financial content I read almost never discussed the emotional toll that debt can take. Here I was feeling paralyzed by my debt and there was nothing to help me through it. I felt alone, ashamed, and guilty.

As a way to address the emotional aspects of debt and deal with the emotions that were holding me back, I wrote break up letters to debt.

These breakup letters helped reclaim some of my power and agency in my situation. I no longer felt like debt was bossing me around, but I was taking action and letting the world know I was done with debt. The debt letters helped me stay accountable to paying off my debt.

In addition to writing my dear debt letters, I’ve invited other debt fighters to write their own breakup letter to debt. Many of the authors have told me the experience has been cathartic and transformative for them. Writing these letters helps them keep up momentum on the long journey ahead.

If you’re working to get out of debt, consider writing a breakup letter to your debt. No one has to see it but you. Just the act of writing it down can make you feel better and shift your mindset toward action.

If you’re working on building wealth, you can write a love letter to money instead. Express how excited you are to grow together and create a lifelong relationship.

Why this strategy works: Writing a letter is a creative, fun way to boost your money mindset and shift the energy in the right direction to reach your goals. Additionally, writing down your goals can help you reach them.

Dr. Gail Matthews, a psychology professor at Dominican University, found out in a study that people who write down their goals have a much higher chance of achieving them compared to those who don’t. Writing those goals down can be a lot more powerful than you may realize.

How to get started:

Using either pen and paper or a word processor, write a breakup letter to debt or a love letter to money. Write out all your emotions without any judgment. Be clear about what you want and set your intentions.

2. Write a check with your dream salary

When I was struggling to find work and pay off debt, I felt so low. I had cut my budget to the bone and still didn’t make the kind of money that would support my debt payoff goals. One day, I was talking to my mom, and she suggested I write out a check to myself with my dream salary on it.

At this time, I was on food stamps, making just enough to get by. I thought the suggestion sounded a bit new-agey and ridiculous – but I tried it anyway.

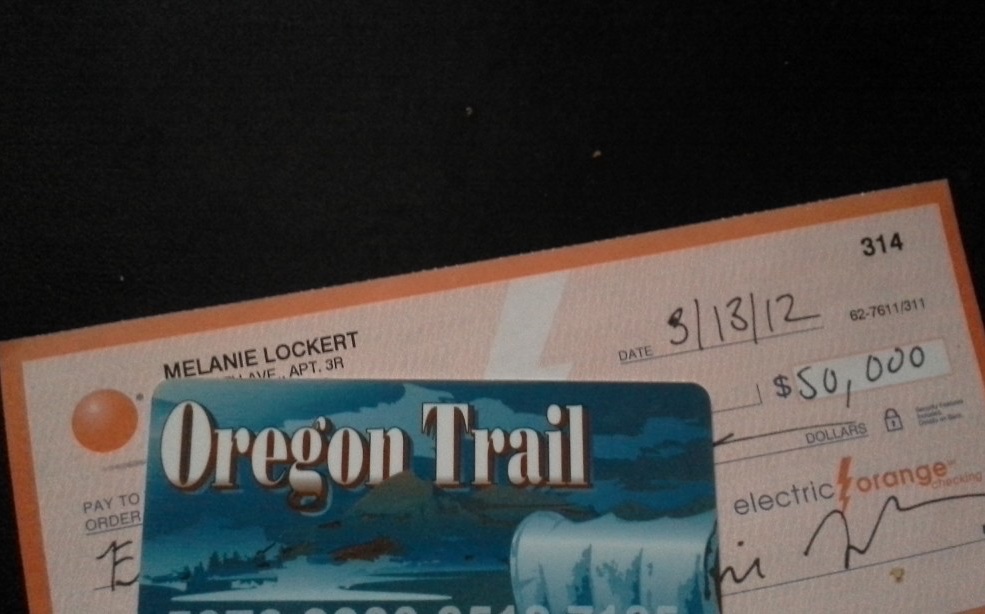

So I wrote a check of $50,000 to myself (yes, at that time $50,000 was my dream salary). For the next few years, I kept it on my desk to see every day.

Some days, I’d look at it and feel so far away from my goal. When I ended up getting a full-time job, I was a little closer, but still far away. Approximately three years after I wrote that check, I stumbled upon it and realized that, through self-employment, I had reached my goal. I couldn’t believe it.

Something that I used to think wasn’t possible became my reality.

Turns out my mom had heard about this tactic from actor Jim Carrey. When Carrey was struggling to get by, he wrote a check to himself for $10 million and dated it in the future. He was able to reach his goal in a few short years through his film Dumb and Dumber.

Writing a check to yourself with your dream salary can crystallize your goals and ensure that they are always in sight.

Why this strategy works: This exercise forces you to think about your dream salary and what amount of money will help you achieve your financial goals. Writing it down and keeping it with you can help you stay focused. Of course, you have to do your part too and put in the hard work. You can’t visualize your way to success without putting in the time and effort. But with this exercise and a lot of hard work, you may be able to reach your dream salary faster than you think.

How to get started:

Take out a check and make it out to yourself. Be specific about the amount and don’t forget to dream big! List a date in the future that reflects when you hope to achieve your goal (I missed this part when I did the exercise). This may be a few years in the future or even a few decades, but it’s important to be clear on this. If you want to be even more focused, you can write in the memo section what the check was for. Once you’re done writing yourself a check with your dream salary, put it on your desk or the fridge.

3. Do an art project

Working on your financial goals doesn’t seem that fun. In fact, when you’re in the thick of reaching your goals, it can feel quite boring and restrictive. But there’s a way that you can infuse some life into your financial goals: create an art project around them.

Now, you don’t have to be a “serious artist” or even have artistic skills to do this. Like the other exercises, it’s all about visualizing your financial goals and making it fun.

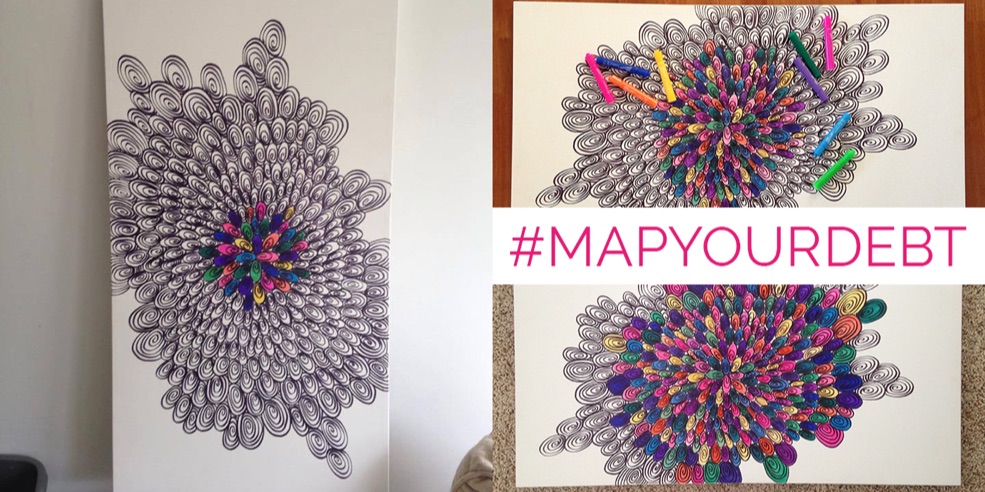

Amy Jones doodled her way to debt freedom. Through her drawing of swirls, she paid off over $26,000 in credit card debt. She started with a black sharpie and created numerous swirls representing her debt. For every $100 she put toward debt, she colored in a swirl. With each swirl, she became more and more motivated to color and “complete the picture”.

You can do a similar thing whether you’re in debt, saving for your emergency fund, or saving for your dream vacation. The beauty is that you can use this exercise for any financial goal.

Aside from creating a drawing like Amy did, you could also create other visual representations of your debt through a progress bar, charts, and more. Need some ideas? Check out this post.

Why this strategy works: When you’re working hard to reach any financial goal, it can be hard to build momentum — especially if you’re striving for something that you feel is out of reach. By creating an art project related to your financial goals, you can visualize your progress and get inspired to continue.

How to get started:

You can create your art project with whatever shape or design you want. Simply set a metric for your drawing. For example, each swirl represents $100 and keep at it. If you feel intimidated by this, you can use digital printouts to get started. Then be consistent and track your progress. You can now turn financial goal-setting into something you look forward to, rather than just another chore.

Motivation for the Win

Whether you’re working hard to pay off debt, build an emergency fund, save for a house, or pay for your dream vacation in cash, it’s key to set financial goals so you can stay motivated and track your progress as you go. Without setting financial goals, it’s just too easy to spend mindlessly and just go through the motions.

But when it comes to setting financial goals, motivation is half the battle. So when you make financial goal setting fun, you’re more likely to achieve your goals.