The Best Mobile Apps for Investing of 2026

Investing can be very intimidating to get started with.

With so many investment options, it’s hard to know what to choose.

Worse, you might be worried about your investment losing value.

We’ve put together this list of apps that can help first-time investors get started.

Whether you want to learn, save a few pennies at a time, or get into stock trading, there’s an app for you.

Best Mobile Apps for Investing of 2025

- Acorns

- Stash

- Betterment

- SigFig

- Empower

- Wealthfront

- Robinhood

- TD Ameritrade

- M1 Finance

- Learn

- StockTwits

- TradeHero

Micro-investing

Micro-saving apps are designed to help you save money, a few cents at a time.

You’d be surprised at how quickly you can build up a significant balance from just a few pennies here and there.

Acorns

How it works

When you set up an Acorns account, you’ll link your existing debt and credit card accounts to the service.

Every time you make a purchase using a linked card, Acorns will round up the total to the nearest dollar.

So, if you buy a coffee for $4.47, Acorns will round that cost up to $5. The coffee seller will get the $4.47, the remaining $.53 will be automatically deposited to your Acorns account.

When you set up an account, you’ll answer questions so Acorns can determine your investment risk tolerance.

Acorns will take the money in your account and invest it in a mix of stocks and bonds according to your risk tolerance.

For retirement savings, there’s the Acorns Later plan that includes IRAs and automated portfolio management.

Who it’s for

Acorns is for anyone who wants to invest while they spend money and build a balance a little bit at a time.

How much it costs

Acorns offers three tiers:

- Acorns Core

- Acorns Later

- Acorns Spend

Acorns costs $1 a month for its Core plan. College students get this plan for free.

Users can get Acorns Core and Acorns Later for $2 per month.

User can get all three plans for $3 per month.

Available on

Stash

How it works

Stash lets you start investing with as little as $5, making it easy to open an account.

You can add small amounts to your account whenever you’d like, whereas many brokerages require you to invest hundreds at a time.

Stash lets you invest in one or more of its 30 different investment options that focus on different sectors of the economy.

Who it’s for

Stash is for anyone who wants to get started investing, but who cannot afford the high minimums required by brokerage firms.

How much it costs

Stash costs $1 per month, or 0.25% per year once your portfolio value exceeds $5,000.

For retirement accounts, the fee is $2 per month for balances less than $5,000 and 0.25% per year of assets with balances above $5,000.

Available on

Robo-Advisors

Robo-advisors aim to provide all the benefits of professional investment management, at a fraction of the cost.

These companies rely on complicated algorithms to invest your cash and maximize your returns.

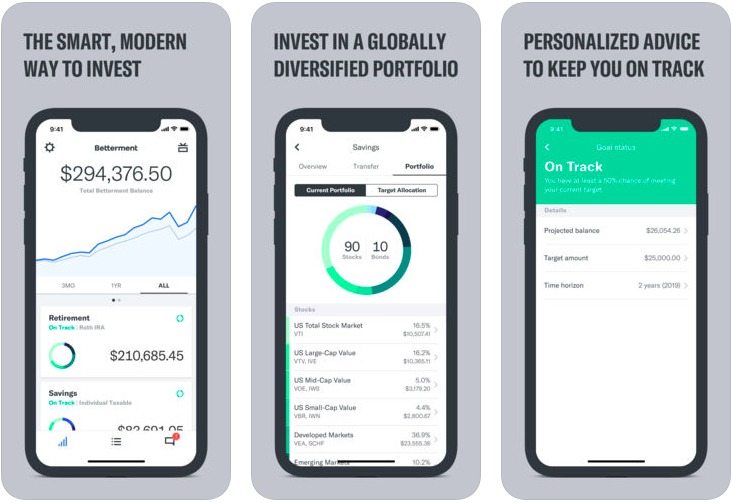

Betterment

How it works

When you open an account at Betterment, the first thing you’ll do is answer a survey.

Betterment’s robo-advisor will use this to determine what your investing goals and risk tolerance.

Then, Betterment will take whatever money you deposit to your account and automatically invest in broad-based exchange-traded funds (ETFs).

Betterment does all the work for you, all you have to do is deposit or withdraw money as desired.

Who it’s for

Betterment is for people who want to invest their money, but who don’t want to manage their investments.

How much it costs

Betterment charges a fee of 0.25% of your balance annually.

The Premium plan (for $100,000 minimum balances) has an annual fee of 0.40%.

Available on

SigFig

How it works

SigFig lets you keep your money in its existing accounts, while still receiving the advantages of its robo-advisory service.

When you sign up, you’ll give SigFig the information for your accounts at other brokerages, like TD Ameritrade, Fidelity, or Charles Schwab.

SigFig will then take over managing those accounts, rebalancing, reinvesting, buying, and selling as needed.

Who it’s for

SigFig is for people who have accounts at outside brokerages, but who still want to use a robo-advisor.

How much it costs

The first $10,000 under management is free. All other assets cost 0.25% per year.

Available on

Empower

How it works

Empower offers a combination of financial tracking software and robo-advisory.

When you set up your Empower account, you’ll link all your outside financial accounts. Empower will then download your balance and transaction information.

It will provide a dashboard that lets you see your whole financial life in one place.

Empower’s robo-advisory service will automatically invest your money to help you meet your long-term goals.

Who it’s for

Empower is for people who want a way to track their money, but who don’t want to deal with managing it on a daily basis.

How much it costs

There is a tiered pricing system for Empower.

Balances under $1 million are charged a fee of 0.89% annually.

Balances over $1 million are charged:

- First $3 million: 0.79%

- Next $2 million: 0.69%

- Next $5 million: 0.59%

- Over $10 million: 0.49%

Available on

Wealthfront

How it works

When you open a Wealthfront account, you’ll answer a survey that lets Wealthfront understand your risk profile and goals.

Wealthfront will use that information to design an investment plan, and will then manage your money for you, aiming to meet your financial goals.

Wealthfront’s algorithm aims to minimize risk, taxes, and fees.

Who it’s for

Wealthfront is for people who want to invest, but don’t want to manage their investments.

How much it costs

Wealthfront charges an annual fee of 0.25% of your balance.

Available on

Stock-Trading

Investing in individual stocks is exciting, but risky.

If you want to try your hand at stock-picking, try these apps.

Robinhood

How it works

Robinhood lets you invest in individual stocks without paying any transaction fees.

All you have to do is deposit money to your Robinhood account, then decide which stocks you’d like to purchase.

You can also sell stocks that you’ve purchased without paying a fee.

Who it’s for

Robinhood is for people who want to purchase stocks in individual companies, without paying brokerage account fees.

How much it costs

Robinhood does not charge account maintenance or trading fees.

Available on

TD Ameritrade

How it works

TD Ameritrade is a traditional brokerage that offers a fully-featured app for investing.

You can open an account and invest in individual stocks, and other investment products.

One of TD Ameritrade’s biggest draws is that it offers overnight trading. Normally, you can only make trades during market hours (9:30 AM – 4 PM Eastern time).

TD Ameritrade offers 24-hour a day trading, 5 days a week.

Who it’s for

TD Ameritrade is for people who want to be able to trade stocks any time of the day or night.

How much it costs

Online equity trades are free, regardless of the number of shares involved.

Other transactions have varying fees.

Available on

M1 Finance

How it works

M1 Finance offers you the chance to create a customized, automated investing portfolio.

When you sign up, you can build a portfolio of stocks and ETFs that you hand-choose.

You can also select from one of the dozens of pre-built portfolios.

Once you’ve built your portfolio, all you have to do is add money to your account. M1 Finance will do the rest for you.

Who it’s for

M1 Finance is for people who want a bit more flexibility than robo-advisors offer while keeping the benefits of automated investment.

How much it costs

M1 Finance does not charge any fees or commissions for investing but does charge other miscellaneous account fees.

Available on

For Investing Education

If you just want to learn more before getting into the world of investing, these apps can help.

Learn

How it works

Learn offers easy-to-understand, quick lessons that you can read or listen to whenever you want.

These lessons teach you about the basics of how different investments work and different strategies that you can use.

Who it’s for

Learn is for people who want to learn more about investing in short-burst lessons.

How much it costs

Learn is free.

Available on

StockTwits

How it works

StockTwits is a social media platform for investors where anyone can share their thoughts about investing.

You can use it to read up on the latest news and opinions about popular investments.

Who it’s for

StockTwits is for anyone who wants to talk about investments or to read other people’s investment opinions.

How much it costs

StockTwits is free.

Available on

TradeHero

How it works

TradeHero is an investing game where you can trade stocks using fake money.

This lets you get experience with investing without risking any of your own cash. If you do well, you can get followers who pay to subscribe to your trades to see how you’re investing.

You’ll get paid for every premium follower you get.

TradeHero features social and gamification functions, including a leaderboard where you can see how you perform compared to other investors.

Who it’s for

TradeHero is for anyone who wants to practice investing without risking their own cash.

How much it costs

TradeHero is free.

Available on

iOS and Android

Conclusion

For a long time, investing was daunting and overwhelming.

With companies introducing easier ways to get started, especially through mobile apps, rookie investors can dive right in to test the waters with low-cost options.