Buying a House With Friend or Family Member: A Bad Idea?

Saving your money can be a job in and of itself when you’re trying to put away towards a particular goal. One goal that may be exceptionally difficult is homeownership.

Homeownership may seem like an unachievable financial goal, more so when you’re trying to achieve it by yourself.

Usually, people buy a home with a spouse or partner, but there’s no rule that says you must be in a relationship with someone to buy a property with them.

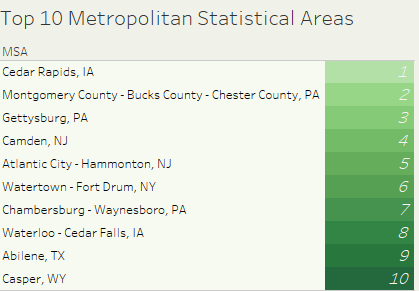

As noted in a recent study by Nationwide, about half of Metropolitan Statistical Areas (MSAs) have a positive ranking, which means that a downturn in housing in highly populated regions is highly unlikely over the next one to two years.

So, it’s not uncommon to go into a home purchase with a friend or family member. However, the question then becomes: is it a good idea to join up on such a venture?

Learn about the pros and cons of this move before you and friend(s) or family commit to this financial goal.

Why Consider Buying with Friends or Family?

The reality is any two people can purchase a home together. You can buy a home with your child, sibling, parent, or another relative. And, moreover, even friends can go into a purchase together.

When two people plan to live together and share expenses, they might reason it’s wiser to purchase instead of wasting money on rent, which offers no real stability.

Landlords and property managers can increase rental rates each year, yet renters get nothing new in return.

Buying, on the other hand, offers predictable monthly payments, making it easier to budget long-term.

While mortgage lenders will allow two people to apply for a home loan together, it’s important you fully understand the pros and cons of this arrangement, as well as practical ways to protect yourself.

Pros of Buying a Home With a Friend or Family

So, what are the benefits of getting into a mortgage loan with a friend or a family member?

Enter the housing market sooner

The price to buy a home may be expensive, but studies show prices will only increase as time goes on.

According to the Health of Housing Markets Report 2018Q3 by Nationwide, the imbalance between supply and demand of homes has caused price increases in two-thirds of the country’s 400 metropolitan areas over the past year.

Further discovered by the study, prices have been hiked up in two-thirds of the country’s 400 metropolitan areas in the past year alone.

If home prices in your area happen to be affordable, breaking into the market now could be cheaper than waiting five years. If you plan to live together for the next several years, you can purchase a home together, wait for the property to appreciate in value, and then sell and split the equity.

Buying together can be a steppingstone to getting your own mortgage later on.

Joint ownership makes it easier to qualify for a mortgage

Buying a home with another person also makes it easier to qualify for a home loan. When applying for a mortgage with a joint owner, you’re able to pool your resources.

Therefore, the amount you contribute to the mortgage payment, down payment, closing costs, and other expenses will be less than if you applied for the loan alone.

Mortgage lenders also use your combined income to determine your qualifying amount, making it easier to get a bigger home or a property in a nice area of town.

Opportunity to increase your personal savings

Maybe you are in a position to purchase a home alone. Just because you can, however, doesn’t mean that you should.

When buying a home alone, you’re responsible for 100 percent of the mortgage payment, utilities, maintenance, and repairs — this can quickly eat into your income and extra money.

When buying with another person, you’re able to keep monthly expenses to a minimum and possibly live beneath your means. As a result, you can build a healthy savings account and put your money to other good uses.

Beef up your retirement funds, travel more, pay off debt, or tackle other financial goals.

You can write off mortgage interest

If you itemize your tax return, buying a property also gives you an opportunity to write off mortgage interest and property taxes (and other eligible home expenses).

This can lower your taxable income. Keep in mind, however, that while you’re able to split the mortgage deduction with the other owner, you can only deduct your share of the interest paid.

This is easy to calculate if you and the other owner split the mortgage payment down the middle.

But if you have another arrangement, say a 60/40 split, you must first calculate your share of interest and property taxes, and then deduct this amount on your tax return.

Cons of Buying a Home With a Friend or Family

Of course, problems can also arise when you make the decision to purchase a home with a friend or a relative.

Here’s some of the main cons you should be thinking about:

Possibility of a higher mortgage rate

Not only will the mortgage lender consider both parties’ incomes when approving your application, but the lender also examines both of your credit scores.

Your credit score not only determines if you qualify but also your interest rate on the mortgage. This isn’t a problem if both you and your co-owner have high credit scores.

On the other hand, if your credit score is high and your co-owner’s credit score is low, your lender uses the lowest score when determining the mortgage rate.

This could result in a higher rate and a higher mortgage payment.

Unequal splitting of the mortgage payment

Another drawback is possibly becoming responsible for a larger portion of the mortgage payment, or worse, the entire mortgage payment.

Anything can happen after qualifying for a mortgage and moving in. Your co-owner could lose his or her job, or run into other financial hardship, leaving you with the mortgage.

Of course, these are worst-case scenarios, but you must consider how you would handle the mortgage if you’re stuck with the payment.

Falling behind on a mortgage payment damages your credit score and puts you at risk for foreclosure.

Harder to move when buying with a friend or family

If you rent a house or apartment with a friend or family member, it’s easier to move when you decide to go your separate ways.

Simply wait for your lease to end and move out; it’s not that simple when you own a property together.

Listing the home for sale, and then waiting for a buyer could take several months (or longer) depending on your local market.

Another possible scenario is if your co-owner wants to move out, but you want to continue living in the home. In a case like this, you’ll need to refinance the home loan and remove his or her name from the mortgage.

In order to do any of these things, however, you must be able to afford the mortgage payment on your own.

Buying With Friends or Family: Should You Do It?

This isn’t a yes or no answer — you have to decide for yourself after weighing the pros and cons.

The arrangement can work, but only if you and the other person are candid and honest about expectations.

This isn’t a decision to take lightly, so it might help to talk to people who have been in this situation for insight into their experience.

From here, it might be easier to decide whether this living arrangement can work for you. It’s important to put your emotions aside and be realistic about the other person.

Is this person responsible with money? How is his or her credit rating? Has he or she ever been evicted? Can you trust him or her?

Don’t be afraid to ask questions about his or her credit and finances. If you’re too timid to have these tough conversations, then you’re not ready to buy a home together.

If you have any doubts or reservations, don’t move forward with a home purchase.

Steps to Take to Ensure a Smooth Deal and Relationship

Even if you feel the other person would make an excellent “mortgage buddy,” things can go downhill in the future.

How do you protect yourself? Consider these steps:

Hire an attorney

Consider having a property agreement and a cohabitation agreement drawn up by an attorney. This way, all expectations are in writing and there are no misunderstandings.

This agreement can outline how much each person will pay toward the down payment, closing costs, repairs/maintenance, as well as details surrounding tax deductions and how you’ll split profits upon the sale of the home.

Save, save, and save some more

Shared living expenses can result in more disposable income.

Make sure you’re putting cash aside each month in the event you have to pay the entire mortgage for a month or a few months. This might happen if the other owner loses his or her job or can’t work due to injury or illness.

Preparing for the unexpected can potentially protect your credit score and save the property from foreclosure.

Get a term life insurance policy

Both of you should have a term life insurance policy listing the other person as the beneficiary. In the event the other owner dies, a life insurance policy can provide you with much-needed funds.

By getting a term life insurance policy, you’re able to continue making mortgage payments, or perhaps pay off the mortgage balance.

Final Thoughts

Some people may say you shouldn’t buy a house with someone who isn’t your spouse. The fact of the matter is, this issue isn’t always black or white.

Buying a house with a family member or friend could be financially rewarding and beneficial in the long run.

Just make sure you know the risk, and take measures to protect yourself, in case the relationship goes south.